Unlocking Financial Possibilities with Laen Tagatisel

Laen tagatisel, or loan collateral, serves as a powerful tool in the financial sector, especially for those looking to invest in real estate or seeking financial services. In this comprehensive article, we will delve deep into the various aspects of loan collateral, its significance, and how it can be leveraged for successful financial ventures.

What is Laen Tagatisel?

The term laen tagatisel refers to a loan that is secured by collateral—an asset that is pledged by the borrower to secure the loan. This could be in the form of property, real estate, vehicles, or other valuable assets. The underlying principle is simple: if the borrower fails to meet the repayment obligations, the lender has the right to seize the collateral to recover the loan amount.

The Importance of Loan Collateral in Financial Services

In the realm of financial services, laen tagatisel plays a crucial role in determining the terms of the loan offered. Here are a few key points highlighting its importance:

- Risk Mitigation: For lenders, having collateral significantly reduces the risk associated with lending money. If a borrower defaults, the lender can recoup their losses by seizing the collateral.

- Better Loan Terms: Loans that are secured with collateral generally come with lower interest rates and more favorable repayment terms due to the decreased risk for the lender.

- Easier Approval Process: Borrowers may find it easier to secure a loan when it is backed by collateral, as it assures lenders of repayment, regardless of the borrower's credit history.

Types of Collateral for Laen Tagatisel

There are various forms of collateral that can be used to secure a loan. Understanding which assets are acceptable can help borrowers make informed decisions:

1. Real Estate

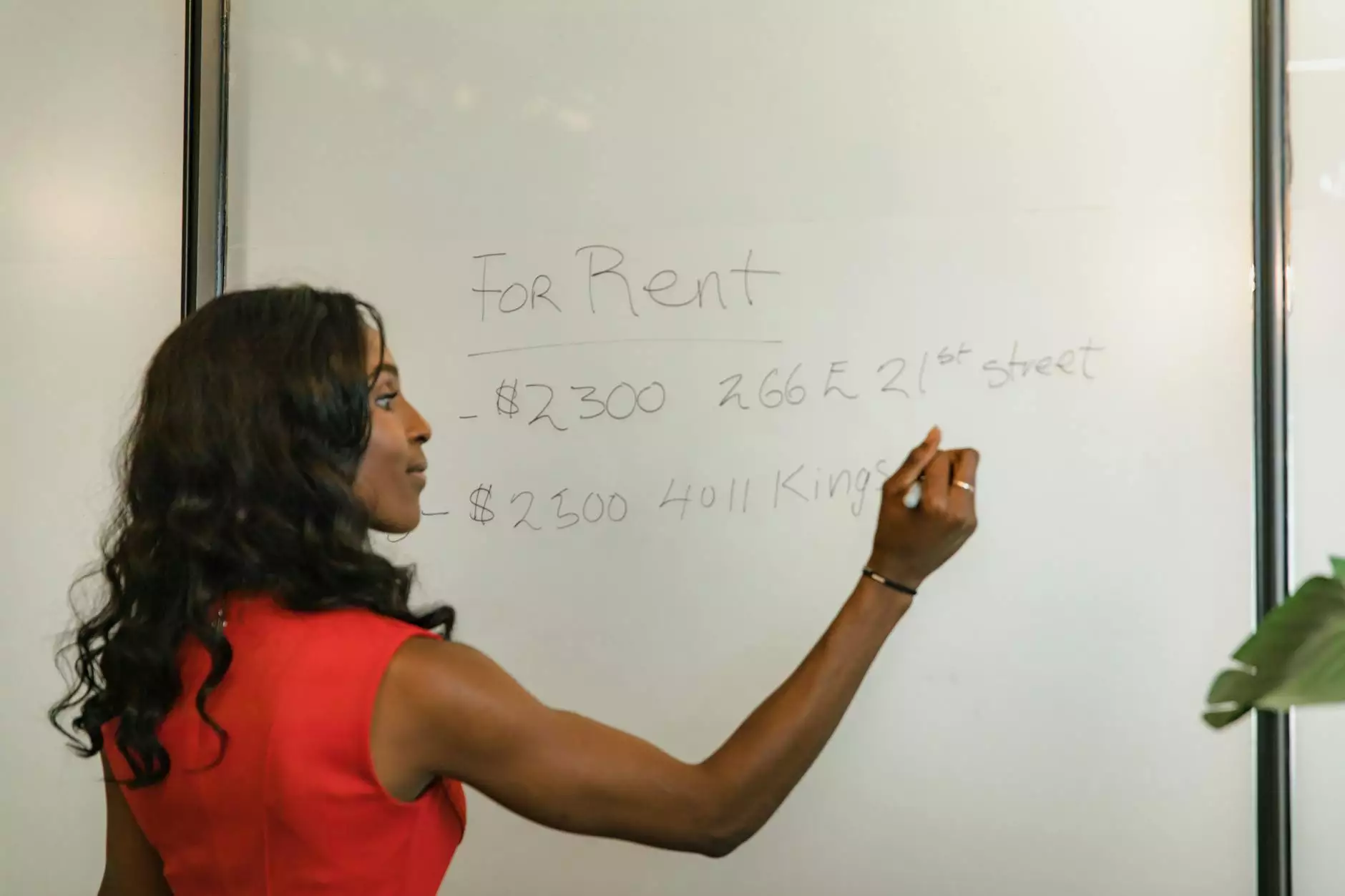

One of the most common forms of collateral is real estate. Properties such as homes, commercial buildings, and land can be used to secure loans. Lenders often prefer real estate because of its stable value and potential for appreciation over time.

2. Vehicles

Cars, trucks, and other vehicles can also be used as collateral. The vehicle's value is assessed, and a loan can be issued based on a percentage of that value.

3. Savings Accounts and CDs

Borrowers can also use savings accounts or certificates of deposit (CDs) as collateral. This is often a safer option, as the lender can easily access the funds in case of default.

4. Personal Property

Valuable items such as jewelry, art, and collectibles can also serve as collateral, although this is less common compared to real estate and vehicles.

How Laen Tagatisel Works

The process of obtaining a loan collateralized by an asset typically involves several steps:

Step 1: Evaluation of Collateral

The first step is to assess the value of the collateral. A professional appraisal may be conducted, particularly for real estate, to determine its market value.

Step 2: Loan Application

Once the collateral value is established, the borrower can fill out a loan application with the lender. This includes providing information about the collateral, financial status, and reason for the loan.

Step 3: Approval Process

The lender will review the application, assess the borrower's creditworthiness, and evaluate the collateral. If everything checks out, the loan will be approved.

Step 4: Loan Agreement

Once approved, the borrower and lender sign a loan agreement that outlines the terms, interest rates, repayment schedule, and the specifics regarding the collateral.

Benefits of Using Laen Tagatisel

Opting for a laen tagatisel can provide numerous benefits to borrowers:

- Lower Interest Rates: Loans backed by collateral typically have lower interest rates compared to unsecured loans.

- Increased Borrowing Capacity: Having collateral allows borrowers to secure larger loan amounts since they provide a safety net for lenders.

- Quick Access to Funds: The approval process tends to be faster, allowing borrowers to access funds promptly when needed.

Common Mistakes to Avoid When Opting for Laen Tagatisel

While laen tagatisel presents numerous advantages, there are also pitfalls to avoid:

1. Overvaluing Collateral

Borrowers should realistically assess the value of their collateral. Overvaluation can lead to borrowing more than what can reasonably be repaid, increasing financial strain.

2. Ignoring Loan Terms

It's vital to read the fine print. Understanding the terms of the loan, including fees, penalties, and interest rates, is crucial to avoid unpleasant surprises.

3. Failing to Communicate with Lenders

If you anticipate difficulty in meeting repayment deadlines, communicate with your lender early. They may offer solutions or adjustments to your payment plan.

The Future of Laen Tagatisel in Business Finance

As the financial landscape evolves, the concept of laen tagatisel will continue to be relevant. With increasing property values and a rising demand for accessible funding options, both individuals and businesses can benefit from secured loans. The future will likely see:

- More Flexible Loan Options: Lenders may offer more diverse collateral options, catering to a broader range of borrowers.

- Technology Integration: Digital platforms may streamline the process of evaluating collateral and offering loans, making it more accessible.

- Increased Awareness: As more people understand the benefits of secured loans, we may see a rise in demand for laen tagatisel.

Conclusion

Understanding the significance of laen tagatisel is essential for anyone looking to enhance their financial strategy. By leveraging the right collateral, borrowers can access capital that can fuel their *business* endeavors, invest in real estate, or solve immediate financial challenges.

At reinvest.ee, we are committed to providing you with the insights and services needed to optimize your financial choices. Whether you are considering a loan for real estate investment or navigating financial services, having a clear understanding of loan collateral can open the door to myriad opportunities. Invest wisely, leverage correctly, and unlock your potential with laen tagatisel.